Income Tax (Fifth Amendment) Rules, 2024, replaces Form ITR-V in Appendix-II of the Income-tax Rules, 1962. This amendment, authorized by […]

Category: Incom Tax

Directorate of Income Tax (Investigation), Delhi चुनाव में काले धन की भूमिका को रोकने के लिए टोल-फ्री मोबाइल नंबर 9868168682 जारी

Directorate of Income Tax (Investigation), Delhi चुनाव में काले धन की भूमिका को रोकने के लिए टोल-फ्री मोबाइल नंबर 9868168682 […]

Tax-Saving Investments: Full list of tax-saving schemes as current financial year set to end

Tax-Saving Investments: Full list of tax-saving schemes as current financial year set to end Effective tax planning minimizes tax liabilities, enhancing […]

Indira Gandhi Pyari Behna Samman Nidhi Yojana

Indira Gandhi Pyari Behna Samman Nidhi Yojana In India, various state governments have launched several welfare schemes for women. These […]

Maximizing Tax Savings for FY 2023-24: Strategies and Opportunities

Maximizing Tax Savings for FY 2023-24: Strategies and Opportunities Tax-saving strategies for FY 2023-24 deadline (March 31, 2024) include home […]

Income-Tax advance Tax e-campaign for F.Y. 2023-24 आयकर विभाग वित्त वर्ष 2023-24 के लिए अग्रिम कर ई-अभियान के लिए ई-अभियान चलाएगा

Advance Tax e-campaign for F.Y. 2023-24 आयकर विभाग वित्त वर्ष 2023-24 के लिए अग्रिम कर ई-अभियान के लिए ई-अभियान चलाएगा […]

Income-tax (Fourth Amendment) Rules, 2024 : International Financial Services Centre units

Ministry of Finance, Department of Revenue, Central Board of Direct Taxes, New Delhi, amends Income-tax Rules, 1962. Includes changes in […]

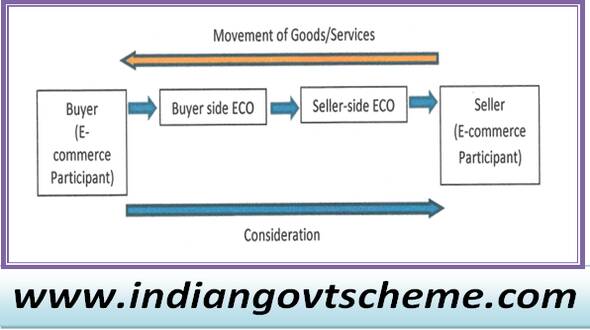

Income-Tax : आयकर अधिनियम, 1961 की धारा 194-ओ के तहत दिशानिर्देश जारी किए

Income-Tax : E-commerce operators (ECOs) must deduct 1% income tax on the gross amount of goods or services sold through […]

IFSC Banking Unit Definition in Sub-Rule Clarified : Income-Tax Twenty Fourth Amendment Rules, 2023

IFSC Banking Unit Definition in Sub-Rule Clarified : Income-Tax Twenty Fourth Amendment Rules, 2023 MINISTRY OF FINANCE (Department of Revenue) […]

Insurance Premiums to investment in parents’ name : 5 ways to save income tax

Insurance Premiums to investment in parents’ name : 5 ways to save income tax Introduction Investing in insurance policies in […]