Income-Tax : E-commerce operators (ECOs) must deduct 1% income tax on the gross amount of goods or services sold through their platforms. Guidelines clarify TDS treatment, including discounts and taxes. Exemption details provided

F. No. 370142/43/2023-TPL

Government of India

Ministry of Finance Department of Revenue

Central Board of Direct Taxes (TPL Division)

Circular No. 20 of 2023

New Delhi, dated 281h December, 2023

Sub: Guidelines under sub-section (4) of section 194-0 of the Income-tax Act 1961 (“the Act”) – reg;

Finance Act, 2020 had inserted section 194-0 in the Act mandating that an e-commerce operator (ECO) shall deduct income-tax at the rate of one per cent of the gross amount of sale of goods or provision of service or both, facilitated through its digital or electronic facility or platform. However, exemption from the said deduction has been provided in case of certain individuals or Hindu undivided family fulfilling certain conditions . This deduction is required to be made at the time of credit of amount of such sale or service or both to the account of an e-commerce participant or at the time of payment thereof to such e commerce participant, whichever is earlier. Any payment made by a buyer to a seller, both e-commerce participants, in a transaction facilitated by the e-commerce operator, shall be deemed to be the payment by the e-commerce operator to the seller and shall be included in the gross amount of sale of goods or provision of services or both for the purposes of tax deduction at source (herein after referred to as the ‘deemed payment’).

2. Sub-section (4) of section 194-0 of the Act empowers the Board (with the approval of the Central Government), to issue guidelines for the purpose of removing difficulties . Earlier, guidelines on section 194-0 of the Act were issued vide Circular no. 17 of 2020 dated 29th September, 2020 and Circular no. 20 of 2021 dated 25th November 2021 . Representations have been received by the Board for further clarifications. In exercise of the power contained under sub-section (4) of section 194-0 of the Act, the Board, with the approval of the Central Government, hereby issues the following guidelines .

3. Guidelines

3.1 Who should deduct tax at source where there are multiple e-commerce operators (ECO) involved in a transaction?

Section 194-0 of the Act mandates that the tax is required to be deducted. where the sale of goods or provision of services or both of an e-commerce participant (buyer or seller) is facilitated by an e-commerce operator (ECO) through its digital facility or platform (by whatever name called).

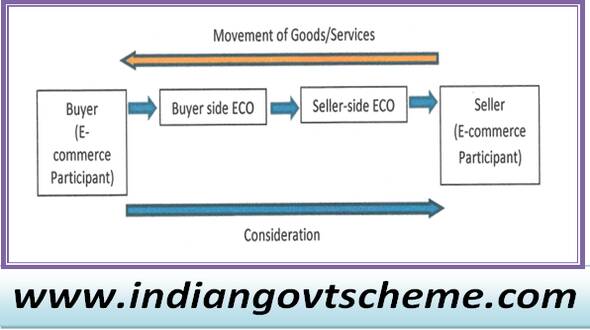

There may be a platform or network (e.g. the Open Network for Digital Commerce) on which multiple e-commerce operators are participating in a single transaction. For example there could be a buyer side ECO involved in buyer side functions and a seller side ECO involved in seller side functions. In this case there may be two situations:

Situation 1: Where multiple ECOs are involved in a single transaction of sale of goods or provision of services through ECO platform or network and where the seller-side ECO is not the actual seller of the goods or services

On the buying side, a buyer-side ECO could be providing an interface to the buyer and on the selling side, a seller-side ECO could be providing an interface to the seller.

In this situation, the compliance under section 194-0 of the Act is to be done by the seller side ECO who finally makes the payment or the deemed payment to the seller for goods sold or services provided.

The tax shall be deducted on the “gross amount” of such sales of goods or provision of services and shall be deducted by the seller-side ECO at the time of credit to the account of a seller (being e-commerce participant) or at the time of payment or deemed payment thereof to such seller by any mode, whichever is earlier. Seller ECO would file the requisite TDS return in Form 26Q and issue certificate to seller under Form 16A.

Situation 2: Where multiple ECOs are involved in a single transaction of sale of goods or provision of services through ECO platform or network and where the seller-side ECO is the actual seller of the goods or services

On the buying side, an ECO could be providing an interface to the buyer and on the selling side, the seller itself is an ECO and is directly interacting with an ECO.

In this situation, the compliance under section 194-0 of the Act is to be done by the ECO which finally makes the payment or the deemed payment to the seller for goods or services sold, which in this case is EC0-2.

The tax shall be deducted on the “gross amount” of such sale of goods or provision of services and shall be deducted by EC0-2 at the time of credit to the account of a seller or at the time of the payment or the deemed payment thereof to such seller by any mode, whichever is earlier. Here, EC0-2 would file the requisite TDS return in Form 260 and issue certificate to the seller under Form 16A.

3.2 E-commerce operators may be levying convenience fees or charging commission for each transaction and seller might levy logistics & delivery fees for the transaction. Payments may also be made to the platform or network (e.g. ONDC) provider for facilitating the transaction. Would these form part of “gross amount” for the purposes of TDS under section 194-0 of the Act?

In e-commerce, it is common for an order to be shipped to the buyer from the seller. It is therefore common for the sellers to charge the buyer additionally for shipping in the form of logistics/delivery/shipping/packaging fees .

Further, the buyer-side ECO and seller-side ECO may charge a commission to the seller to enable the online transaction, and the seller may choose to recoup all or part of that amount from the buyer.

Example 1: A Buyer purchases goods worth Rs 100 from Seller and opts for home delivery. The Seller charges the Buyer an additional Rs 5 as packing fees, Rs 10 as shipping fees, and Rs 3 as a convenience charge (to recoup the fees charged by the seller-side ECO, which includes Rs 1 charged by the Buyer-side ECO and Rs 2 charged by the Seller-side ECO itself). So the seller will issue an invoice for Rs 118 (i.e. Rs 100 + 5+ 10 + 2 + 1) to the buyer. The shipping fees, packaging fees and convenience fees are separately charged to the buyer to provide services in relation to the main supply. In such a case, TDS is to be deducted under sub-section (1) of section 194-0 of the Act on Rs. 118 since this is the gross amount of sales.

It is thus clarified that TDS shall be deducted by the seller-side ECO on the gross amount of sales of goods (Rs 118) or provision of services at the time of payment (including deemed payment) or credit. Seller-side ECO would file the requisite TDS return in Form 260 and issue certificate to the seller under Form 16A.

Under sub-section (3) of section 194-0 of the Act, a transaction on which tax has been deducted by an ECO under sub-section (1) of section 194-0 of the Act shall not be liable to TDS under any other provision of Chapter XVII-B. Accordingly, this exclusion will also apply to the amount received by ECO for provision of services which are in connection with the main transaction of sale of goods or provision of service or both referred to in sub section (1) of section 194-0 of the Act. However, sub-section (4) of section 194S of the Act overrides Section 194-0 of the Act and states that if tax is deducted under section 194-S of the Act, no tax is deductible under Section 194-0 of the Act.

In this example, fees charged by the seller-side ECO (Rs 3 charged to the seller) and buyer-side ECO (Rs 1 charged to the seller-side ECO) for services provided would ordinarily have been subjected to TDS under section 194H of the Act and the seller and seller-side ECO respectively would have had to deduct tax and file TDS return with respect to the fees paid.

However, as tax has been deducted under sub-section (1) of section 194-0 of the Act on the gross amount of sales of Rs. 118, this amount (which includes buyer-side ECO fee of Rs 1 and seller-side ECO fee of Rs 2 charged to the end customer) will not be subject to TDS under any other provision. However, this is subject to provisions of sub-section (4) of section 194S of the Act.

Payments may also be made to the platform or network (e.g. ONDC) provider for facilitating the transaction . These would form part of “gross amount” for the purposes of TDS under section 194-0 of the Act if they are included in the payment for the transaction . If these payments are being paid on a lump-sum basis and are not linked to a specific transaction, then these need not be included in the “gross amount”.

Example 2

Consider a case where the Seller’s label-price for a product is Rs 85, the seller-side ECO’s fee (for listing the Seller catalogue and facilitating the transaction) is Rs 10, and the Buyer side ECO’s fee (to provide an interface to enable the Buyer to discover the seller/product and to enable them to place an order) is Rs 5. The Seller charges the Buyer a total of Rs 100 (Rs 85 + Rs 1O + Rs 5) and issues an invoice for Rs 100 (gross amount), as shown in the diagram above.

The TDS under section 194-0 of the Act will be calculated on Rs 100 (gross invoice value) at the rate of 1%, and that the responsibility of withholding and depositing it would be on the seller ECO. The buyer ECO’s fees (Rs 5) charged to seller-side ECO and seller ECO’s fees (Rs 15) charged to the Seller will not be subject to further TDS (say under Section 194H of the Act.).

3.3 How will GST, various state levies and taxes other than GST such as VAT/ Sales taxi Excise duty I CST be treated when calculating gross amount of sales of goods or provision of services as per the provisions of section 194-0 of the Act?

In Para 4.3.2 of circular no. 13 of 2021 in the context of TDS on purchase of goods, it has been provided that in case the GST component has been indicated separately in the invoice and tax is deducted at the time of credit of the amount in the account of the seller, then the tax is to be deducted under section 1940 of the Act on the amount credited without including such GST.

“4.3.2 Accordingly with respect to TDS under section 194Q of the Act, it is clarified that when tax is deducted at the time of credit of amount in the account of seller and in terms of the agreement or contract between the buyer and the seller, the component of GST comprised in the amount payable to the seller is indicated separately, tax shall be deducted under section 194Q of the Act on the amount credited without including such GST. However, if the tax is deducted on payment basis because the payment is earlier than the credit, the tax would be deducted on the whole amount as it is not possible to identity that payment with GST component of the amount to be invoiced in future.”

Similar clarification was provided in the context of State levies and taxes in para 5.2.3 of Circular no. 20 of 2021.

“5.2.3 In this regard, it is hereby clarified that in case of purchase of goods which are not covered within the purview of GST, when tax is deducted at the time of credit of amount in the account of seller and in terms of the agreement or contract between the buyer and the seller, the component of VAT! Sales tax/Excise duty/CST, as the case may be, has been indicated separately in the invoice, then the tax is to be deducted under section 194Q of the Act on the amount credited without including such VAT/Excise duty/Sales tax/CST, as the case may be. However, if the tax is deducted on payment basis, if it is earlier than the credit, the tax is to be deducted on the whole amount as it will not be possible to identify the payment with VAT! Excise duty/Sales tax/CST component to be invoiced in the future. Furthermore, in case of purchase returns, the clarification as provided in Para 4.3.3 of circular no. 13 of 2021 shall also apply to purchase return relating to non GST products liable to VAT l excise duty/sales tax CST etc.”

Accordingly it is clarified that under section 194-0 of the Act, when tax is deducted at the time of credit of amount in the account of seller and the component of GST/various state levies and taxes comprised in the amount payable to the seller is indicated separately, tax shall be deducted under section 194-0 of the Act on the amount credited without including such GST/various state levies and taxes. However, if the tax is deducted on payment basis because the payment is earlier than the credit, the tax would be deducted on the whole amount as it is not possible to identify that payment with GST/various state levies and taxes component of the amount to be invoiced in future.

3.4 How will adjustment for purchase-returns take place?

It has been clarified in para 4.3.3 of circular no. 13 of 2021 , with respect to purchase returns under section 194-Q of the Act, tax must have already been deducted before the purchase-return. In that case, the tax deducted may be adjusted against the next purchase against the same seller and no adjustment is required if the purchase-return is replaced.

Similarly, it is noted that the tax is required to be deducted under section 194-0 of the Act at the time of payment or credit, whichever is earlier. Thus, before purchase-return happens, the tax must have already been deducted under section 194-0 of the Act on that purchase. If that is the case and against this purchase-return the money is refunded then this tax deducted, if any, may be adjusted against the next transact ion by the deduct or with the same deductee in the same financial year. Further, the tax deducted and deposited will be allowed as credit to the seller.

Further, no adjustment is required if the purchase-return is replaced by the goods, since in that case the transaction on which tax was deducted under section 194-0 of the Act has been completed with goods replaced.

3.5 How will discounts given by seller as an e-commerce participant or by any of the multiple e-commerce operators be treated while calculating “gross amount”?

a) Seller Discount:

In the situation where the discount is given by the seller itself, the seller would reduce the price of the products sold or services provided.

As an example, if the label-price of a product is Rs 100, and the seller offers a discount of Rs 10, Rs 90 will be receivable from the buyer. In this case, the seller will invoice the buyer for Rs 90, and hence the TDS will be calculated on Rs 90.

b) Buyer ECO or Seller ECO Discount:

In cases where discount is given by the buyer ECO/seller ECO, usually the seller receives full consideration for the product, however part of it is received from the buyer and the balance is discharged to the seller by the buyer ECO/seller ECO, as the case may be.

As an example of a discount given by the buyer ECO, if the price quoted by the seller is Rs 100, and the buyer ECO gives a discount of Rs 10, Rs 90 (i.e. 100 – 10) will be collected from the buyer and remitted to the seller, and the buyer ECO will pay the remaining Rs 1O to the seller via the seller ECO. The invoice on the buyer will be raised for Rs 100 and tax will therefore be deducted by the seller-side ECO on Rs 100, which is the gross amount of sales.

khushboo Lather

Under Secretary to Government of India

Copy to:

1. PS to FM/ OSD to FM/ PS to MoS(F)/ OSD to MoS(F)

2. PPS to Secretary (Revenue)

3. Chairman, CBDT & All Members, CBDT

4. All Pr. DGslT/ Pr: CCslT

5. All Joint Secretaries/ CslT/ Directors/ Deputy Secretaries/ Under Secretaries of CBDT

6. The C&AG of India

7. The JS & Legal Adviser, Ministry of Law & Justice, New Delhi

8. CIT (M& TP), Official Spokesperson of CBDT

9. O/o Pr DGIT (Systems) for uploading on official website

10. JCIT (Database Cell) for uploading on www.irsofficersonline.gov .in

नोट :- हमारे वेबसाइट www.indiangovtscheme.com पर ऐसी जानकारी रोजाना आती रहती है, तो आप ऐसी ही सरकारी योजनाओं की जानकारी पाने के लिए हमारे वेबसाइट www.indiangovtscheme.com से जुड़े रहे।