नोट :- हमारे वेबसाइट www.indiangovtscheme.com पर ऐसी जानकारी रोजाना आती रहती है, तो आप ऐसी ही सरकारी योजनाओं की जानकारी पाने के लिए हमारे वेबसाइट www.indiangovtscheme.com से जुड़े रहे।

Insurance Premiums to investment in parents’ name : 5 ways to save income tax

Insurance Premiums to investment in parents’ name : 5 ways to save income tax

Introduction

Investing in insurance policies in your parents’ name can be a strategic financial move, providing both security and potential tax benefits. This article outlines five effective ways to save income tax through insurance premiums in your parents’ name.

Claim Deductions under Section 80D

Under Section 80D of the Income Tax Act, premiums paid for health insurance policies for parents (both dependent and independent) are eligible for deductions. This includes policies in their name where you are the proposer.

Utilize the Gift Tax Exemption

You can gift a premium-paying insurance policy to your parents without incurring any gift tax liabilities. This allows you to leverage their tax slab and exemptions, potentially leading to substantial savings.

Take Advantage of Section 10(14)

Insurance policies are considered a part of salary if provided by an employer. By opting for policies in your parents’ name, you can ensure tax-free benefits under Section 10(14) up to a certain limit.

Leverage the Maturity Proceeds

When the insurance policy matures, the proceeds are typically tax-free for the policyholder. By placing policies in your parents’ name, you can ensure they receive the benefits directly and potentially avoid tax liabilities.

Maximize Wealth Transfer Benefits

By purchasing insurance policies in your parents’ name, you’re effectively transferring wealth to them. This can be a tax-efficient way to provide for their financial security while potentially reducing your own tax liabilities.

Tax burden often increases financial stress and every earning professional wants a way to save the most on their total tax liabilities. Generally, most of the taxpayers invest in tax-saving investment options to claim deductions.

However, choosing the correct options that come with the best tax benefits is essential if reducing tax burden is your ultimate goal. You can save more tax by investing in your parents’ names apart from the popular Section 80 savings options.

Tips to save more on income tax

Insurance premiums: Buying a health insurance policy will enable you to avail tax exemptions under the Section 80D of the Income Tax Act, 1961. These exemptions would be applicable depending on the age of the policy holder. While young people can claim up to Rs 25,000 rebate on medical insurance premiums, senior citizens (aged 60 years and above) get an exemption of up to Rs 50,000. Therefore, getting a health insurance policy for senior members of your family would be helpful in saving higher taxes. In addition, you can buy a life insurance policy to get up to Rs 1.5 lakh exemption under the Section 80C of the I-T Act.

Invest in government schemes: While government schemes are risk-free, some are also tax-free and investing in them would save you a significant amount of taxes. Income tax benefits can be availed by investing in Senior Citizen Savings Scheme (SCSS), National Pension Scheme (NPS), Public Provident Fund (PPF) and Sukanya Samriddhi Yojana (SSY). Moreover, these government schemes offer substantial returns as well, which can be an added advantage.

Invest in Equity-linked Savings Scheme (ELSS) SIPs: Equity-linked Savings Scheme (ELSS) mutual funds are the only mutual funds that offer tax deductions and creating an SIP to invest in ELSS could be helpful in saving taxes. You can claim tax deductions on annual ELSS investments of up to Rs 1.5 lakh under the Section 80C of the I-T Act.

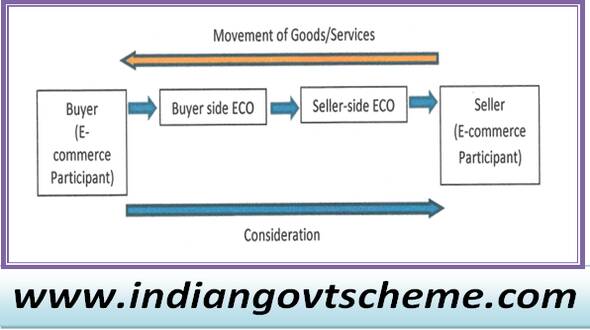

Make investments in your parents’ name: By investing in your parents’ name, you can save taxes under the Section 56 of the I-T Act under the head- “Income from Other Sources”. In case your parents fall into a lower tax slab or the nil bracket then you can save taxes up to Rs 5 lakh.

Charity Donations: By donating to charity, you can claim a deduction on the donation amount under the Section 80G of the I-T Act. Moreover, in some cases you can get a rebate of 100 per cent of the amount donated.

Conclusion

Investing in insurance policies in your parents’ name not only secures their financial well-being but also offers strategic tax benefits. By understanding and leveraging tax-saving provisions like Section 80D and gift tax exemptions, you can make the most of this approach. Additionally, considering factors like Section 10(14) benefits and wealth transfer

Source: https://www.zeebiz.com/personal-finance/news-insurance-premiums-to-investment-in-parents-name-5-ways-to-save-income-tax-stst-255552

*****